HOW TO REDUCE YOUR AVERAGE TERM WITH LEASE-HERE, PAY-HERE

Trevor Watson | January 8, 2020

Anyone familiar with Auto lending, and particularly with subprime auto lending, knows that one of a lenders’ greatest risks is the term they put their loans out at. The longer the average term, the higher their frequency and severity of loss will be. It makes sense, the lender is providing financing to individuals with poor repayment history, and the longer the individual has the loan for, the more opportunities for life events and/or vehicle breakdowns to take place, resulting in default. Severity of loss is also impacted by the term, since the principal balance of the simple interest loan reduces slowly toward the beginning of the loan and accelerates toward the end. Meanwhile, the vehicle depreciates the entire time. This means defaults in the first half of the loan typically result in larger losses than defaults in the last half of the loan. Therefore, the longer your original term, the longer your exposure to the first half of the loan.

The challenge the Buy-Here, Pay-Here industry has encountered over the last decade is the price of vehicles has continued to rise steadily. Numerous factors have played a part, the lack of new vehicle production during the Great Recession, Cash for Clunkers removing existing supply, regulation and market demand pushing new safety technology and MPG efficiency – driving new car costs higher, among other market factors. The result is the traditional “perfect” BHPH car of $10,000 or less is not only harder to come by, it is now an older model year vehicle with higher miles than it was just 5 years ago.

In addition, the BHPH dealers’ customers have not seen their incomes grow at the same rate as the cost of used cars. This has left BHPH dealers in a struggle to put customers with relatively thin incomes into ever more expensive cars or opt to purchase older vehicles with higher miles that come with additional mechanical issues and breakdown far more often.

The result from the steady price inflation (not unlike New car financing) has been dealers resorting to extending the terms of their Buy-Here, Pay-Here notes in an effort to keep monthly payments in an affordable range. According to Subprime Analytics, the average term of a BHPH note has increased over 7 months in the last 8 years to an astounding 43 months in 2018 (44 months in 2017). Attend any BHPH conference and the conversation is constantly around bringing terms back down. Everyone seems to know extended term is injecting risk and losses into their portfolios, however, no one seems to know how to solve for the challenge.

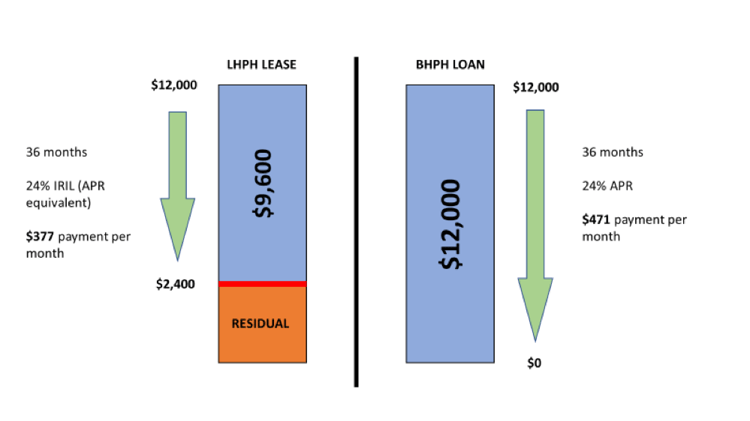

Here is where Lease-Here, Pay-Here offers a solution. By using a lease instead of the traditional Retail Installment Sales Contract (RISC), a dealer can introduce a residual value into the calculation. In the following diagram, you will see a comparison of a LHPH deal on a $12,000 vehicle with a 20% residual versus a BHPH deal on a $12,000 vehicle with a traditional loan. Both deals are at 36 months and both at a 24% interest rate (or IRIL – interest rate implicit in the lease) and you can see the corresponding monthly payment for the customer. The lease offers a base payment nearly $100 less per month.

The BHPH deal would need to extend its term out to 50 months to get a payment in the neighborhood of what the lease can offer at 36 months.

This example is merely scratching the surface. What if you have a particularly strong unit that may have a 25% or 30% residual? You could either, offer the customer an even better payment or shrink your term to 30 or 24 months and their payment would remain the same. Alternatively, the LHPH dealer could offer the customer a $15,000 vehicle on a 36-month lease and have a payment still less than what the BHPH dealer is offering on their $12,000 car. That $15,000 car is likely a year or two newer and with lower mileage than the BHPH dealer’s vehicle. On aggregate, this will likely translate in to fewer mechanical failures and better overall portfolio performance. Not only does this present a competitive advantage for the LHPH dealer, it does so while reducing average term length in the portfolio.

There are solutions to the term challenges the BHPH industry is currently experiencing in the face of increasing used car costs. The key is thinking outside the RISC box and understanding the flexibility a lease model can offer to reduce term and the associated risk.