Texas Sales Tax is favorable with leasing

Eyo Toe | July 13, 2022

When you think about which business models are advantageous for sales tax in Texas, the first that comes to mind is probably Buy-Here, Pay-Here because of pay-as-you-go sales tax. Although you don't get pay-as-you-go sales tax with leasing in Texas, the sales tax benefits could be potentially greater.

With BHPH, a Texas dealership will pay sales tax on the money they receive from the customer. With leasing, the dealer will pay sales tax on the ACV (not the retail price) of the vehicle only once, when the vehicle is leased. Ideally, a LHPH dealer will turn that vehicle through two to three leases until the car is ready to be liquidated via retail, wholesale, or a small BHPH note. When the vehicle is liquidated, the state will give the dealership tax credits on the vehicle's remaining value. These credits can be used to essentially "wash out" future sales tax on inventory over time.

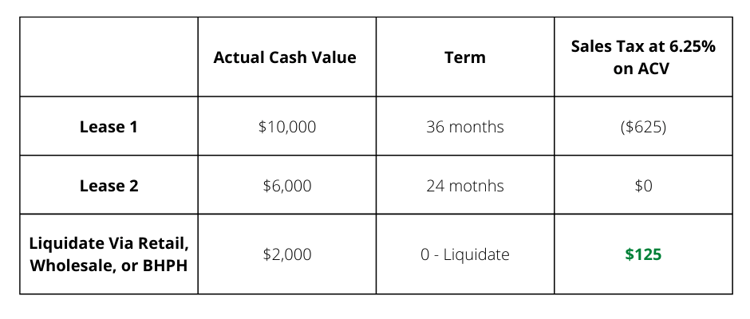

Check out the example below:

For a $10,000 ACV, the dealer would pay $625 up front in sales tax when the vehicle is leased. However, the dealer does not pay sales tax on the second lease for the vehicle and additionally earns $125 in sales tax credits once the vehicle is liquidated which can be stacked to offset future sales tax. $125 might not seem like a big number, however when you multiply that by 15, 30, or 60 cars per month the tax savings making leasing the more advantageous model in the state of Texas even without pay-as-you-go sales tax. In today's world where customer affordability can be challenging, a benefit to this model is the customers on the second or third turn of the lease will not pay tax lowering their overall payment.

If you've thought about leasing but the noticed you were not in a pay-as-you-go state, there are many other benefits to leasing for the dealer and the customer from more affordable customer payments to maximizing the profitability of your vehicles. If you want to learn more about which benefits are the most advantageous for your state, book a meeting with an LHPH team member to get started!