Increased Consumer Bankruptcies Coming

Trevor Watson | January 19, 2023

How do we know there is an oncoming wave of consumer bankruptcies? The first indication is the trend line of delinquency rates. As more consumers fall into the 30 and 60 day-past-due buckets, it becomes clear that more consumers will flow through into repossessions and charge offs that will result in lenders pursuing them for judgements and garnishments. While this process takes time to unfold, once a consumer reaches this level, they will typically file for bankruptcy to wipe those debts out. As more consumers go delinquent due to the numerous financial pressures of the current economic environment, bankruptcies are all but certain to follow.

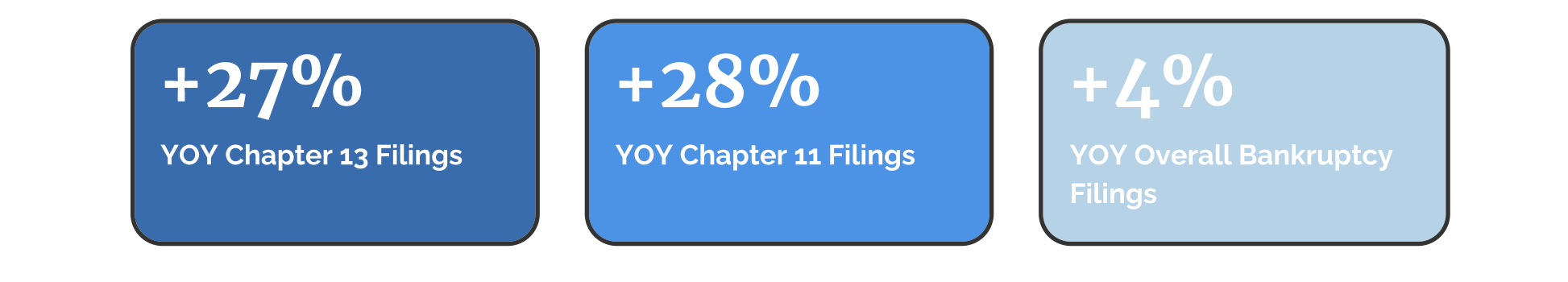

Already, we are seeing the initial uptick appearing in bankruptcy court. According to a report in October 2022 from the American Bankruptcy Institute, Year-over-Year U.S. Bankruptcy Filings Increased in Consecutive Months followed by a 27 percent year-over-year increase in Chapter 13 BK’s in October 2022 (ABI, 2022). The wave is just beginning, with all predictions pointing to a rough 2023 and 2024 as more consumers fight to hang on financially, but eventually needing to rely on the bankruptcy process for a clean restart in the future (ABI, 2022).

Where does this leave a BHPH or LHPH dealer dealing with an influx of consumer bankruptcies in their portfolio? The BK process is time and labor intensive to manage properly and ensure timely reinstatement or recovery of your collateral. For a BHPH dealer, increased filings will impact your collections department by consuming more of their time and resources at the expense of other collections activities, unless you can find ways to create more efficiencies in your processes or choose to increase headcount.

Luckily, for a LHPH dealer using a lease contract, this upward trend is not going to impact them significantly. The reason for this is a lease contract is considered “Bankruptcy Remote,” meaning a true lease cannot be included in a bankruptcy. If a consumer with an active lease files BK, they have two options; (1) “Reject” the lease, meaning they must return the vehicle to the lessor (dealership), or (2) “Accept” the lease, meaning they agree to continue making the full payment agreed to on the lease contract for the remaining term. There are no cramdowns or payment-plans allowed with the lease contract and no need to sell BK accounts to third- party servicers for pennies on the dollar. Whereas a BHPH dealer would be wise to look at process improvements, collector training, and possibly increasing headcount to handle the coming surge, a leasing dealer should weather this storm with minimal operational and financial impact.