BENEFITS OF LHPH

There are 10 core benefits to a LHPH business model:

- Profitability

- Competitive Advantage

- Affordability

- Federal Income Tax Deferment

- Sales Tax Advantage

- Collateral Control

- Bankruptcy Remote

- Customer Retention

- Residual Cashflow

- Flexibility

PROFITABILITY – MULTIPLE TURNS AND ROA

The first question every dealer researching LHPH asks is, “can I make more money with LHPH?” The answer to that question is yes. There are numerous new profit opportunities that come with the implementation of a LHPH program, the first of which is your return-on-asset (ROA).

When you originate a retail installment sales contract, you sell one vehicle to one consumer and then service that loan through its life. A BHPH dealer makes money on the original markup of the car and on the interest received on the monthly payments. Once the customer pays off the loan, the transaction is over and the profit opportunity from that vehicle is complete.

Compare that to a lease-here pay-here deal. You lease your vehicle to the first consumer and then service that lease through its term. The LHPH dealer makes the same profit as the BHPH dealer from the original mark up on the car and earns a rent factor on each payment equivalent to a similar interest rate on the BHPH note. However, when the lease matures, the dealer still retains the vehicle (the asset) and can re-lease the same vehicle again, or sell it, without purchasing new inventory. When the vehicle is leased again, the dealer makes a profit on the markup a second time, as well as the rent factor on each payment (interest) from the new lease, creating a second stream of payments generated from the same asset.

Depending on the original Actual Cash Value (ACV) of the vehicle the dealer rolled on the first lease, some dealers will get two or possibly three turns of the same vehicle before the life of the asset is used up. The ROA potential per vehicle sold through a LHPH process is well beyond anything a BHPH loan can achieve.

PROFITABILITY – LEASE ASSOCIATED FEES

As opposed to the standard RISC structure, a LHPH lease also offers multiple opportunities to drive fee income. These fees can be built into your standard lease contract to deliver increased profitability on a deal-by-deal basis and on your portfolio overall. They include:

- Acquisition Fee- a fee to cover the expenses of arranging the lease agreement

- Purchase Option Fee- gives the customer the opportunity to purchase the vehicle at the end of the lease

- Disposition Fee- a fee charged to return the vehicle and prepare it for the next customer

- Security Deposit- not to be confused with the down payment (cap cost reduction), this will be used in the event that the customer damaged the vehicle.

- Excess Mileage Fees- a fee for exceeding the mileage agreed upon in the lease contract

- Excess Wear & Tear- a fee charged for returning the vehicle in poor condition

The level of these fees varies from dealer to dealer based on their business model and their individual markets. It’s also important to assess fees consistently across all LHPH deals to avoid any disparate impact issues. Once you land on the right mix for your dealership, you will see a significant increase in the profitability of individual deals. A $1,500-$3,000 higher profit on an individual full term LHPH lease versus a similar payment RISC note is a realistic expectation based on how you structure your leases. That is without calculating the impact of a second or third turn of the asset.

COMPETITIVE ADVANTAGE

Buy Here Pay Here is a highly competitive market, often with numerous dealerships in a single city offering in house financing. In many ways it becomes a race to the bottom to offer the lowest price or smallest down payment to secure a customer. This is compounded by the new hyper-connected consumer who, via the internet, has access to shop, compare, and price vehicles without setting foot on a lot. Dealers lose potential customers without even realizing it because they are comparing your offering to your competitors’. The result is dealers sacrificing quality and profitability to sell vehicles and capture market share.

Imagine a dealer n your market adopts a different in-house financing model and suddenly begins offering vehicles four or five model years newer than all their competitors, with half the mileage, for the same or lower monthly payment. Faced with that choice, would a credit challenged customer choose to drive a 9-year-old vehicle with 150,000 miles from their local BHPH dealer, or a 4-year-old vehicle with 70,000 miles from the LHPH dealer for the same payment?

Thanks to the way leases are structured, this dealer can offer the customer a more competitive vehicle for the same payment and, without sacrificing profit. That combination results in a more attractive offer for the customer and ultimately more marketshare.

AFFORDABILITY

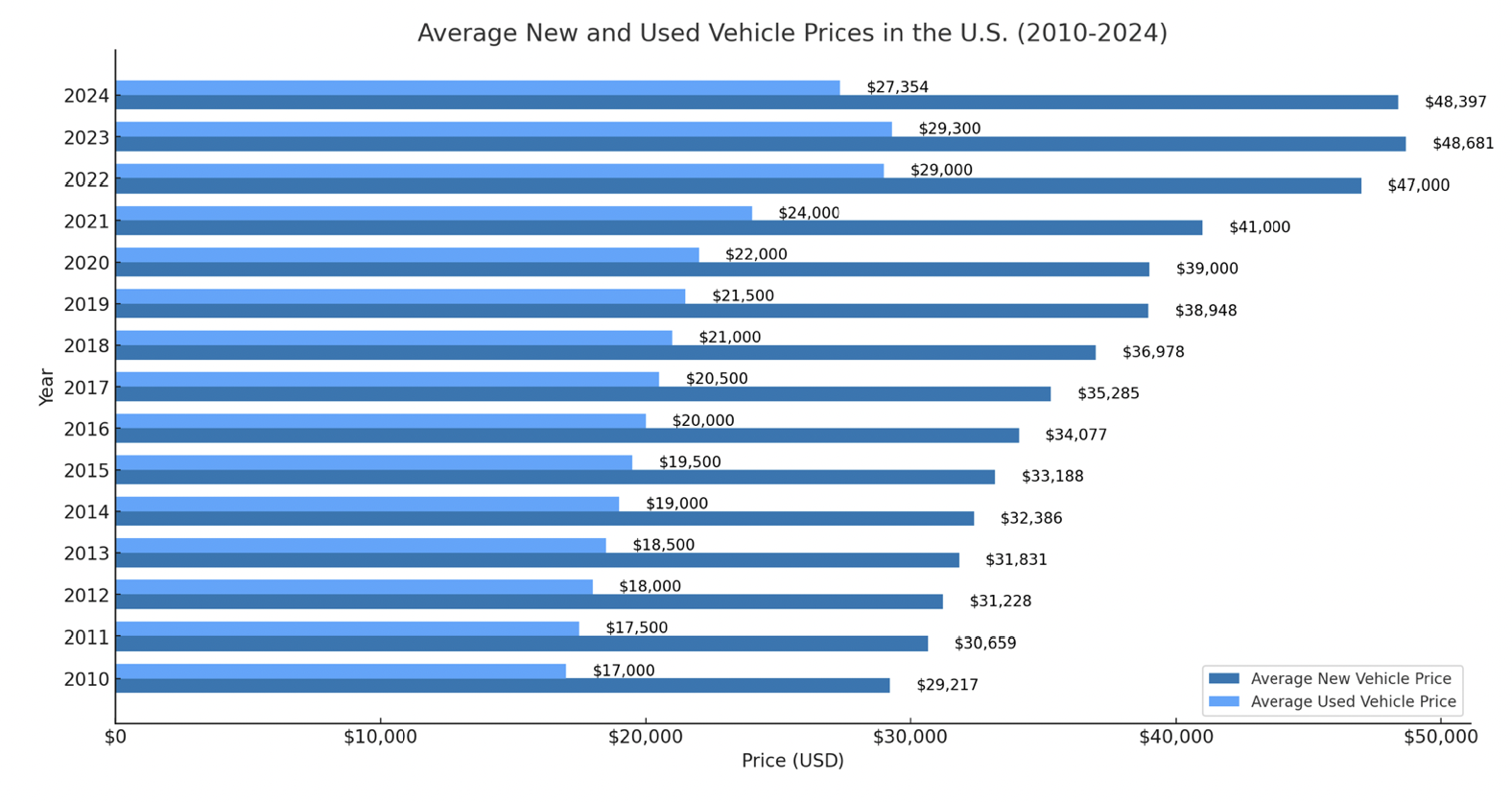

It is no secret that vehicle prices,both new and used, have continued to rise over the last decade. In 2010, the average price of a new car was roughly $29,217; by 2025, new-vehicle transaction prices had climbed to approximately $50,000, marking the first time the U.S. new-car average has crossed that threshold. What often gets overlooked is the impact this has had on used car prices. In 2010, the average used car cost $17,000, but by 2025, mid-$25,000s to over $30,000, depending on vehicle age and market segment, with 3-year-old vehicles averaging more than $30,500 in early 2025. These price increases have created a growing challenge for consumers, especially credit-challenged buyers, who must now stretch their budgets further to secure reliable transportation.

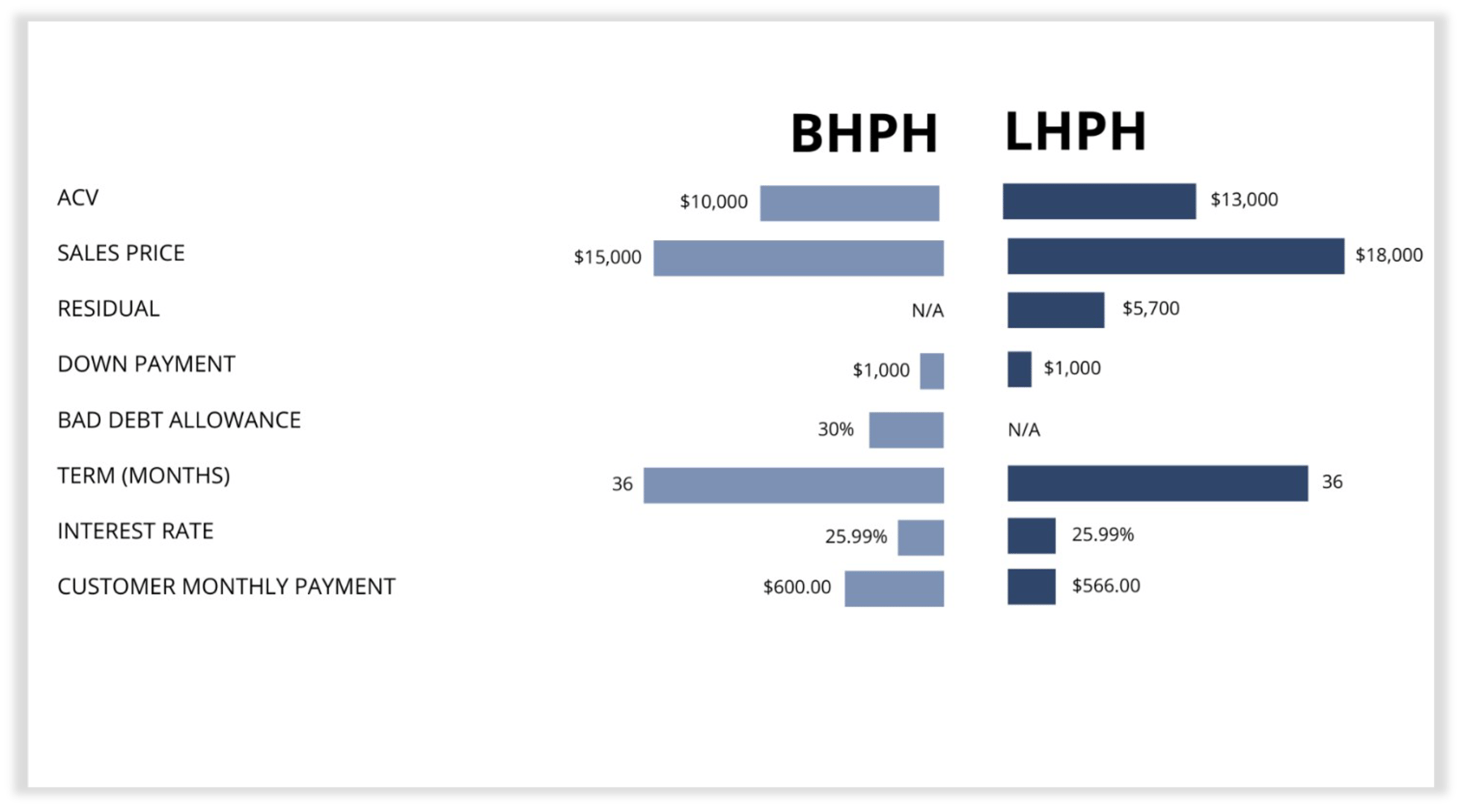

In the in-house financing world, payment and affordability are critical components for success. At an average BHPH structure of a 36-month term and interest rates of 25% or more, the vehicle cost, markup, and down payment together determine a customer’s monthly payment and their likelihood of successfully completing the loan. Placing a credit-challenged customer into a payment of $600 or more per month drastically increases the probability of delinquency. As used-vehicle prices rise, many BHPH dealers are forced to purchase older, higher-mileage units to keep payments affordable. However, these vehicles typically bring higher mechanical risk, which increases defaults when customers cannot afford both repairs and payments. This cycle contributes to elevated service, collection, and repossession costs and ultimately weakens profitability for BHPH operators.

Used-car leasing, on the other hand, offers a structural advantage in combating affordability issues. Because a lease incorporates a residual value, an LHPH dealer can offer a noticeably lower monthly payment on a vehicle with an agreed-upon value of $13,000 than a BHPH dealer can at the same price point, assuming equal down payment, term, and rate. The lower payment improves payment performance, reduces the likelihood of default, and protects long-term portfolio health without requiring the dealer to sacrifice vehicle quality or gross profit.

These older, higher mileage vehicles are more likely to have mechanical issues. When a car is not working properly, and customers do not have the money to pay for repairs and the car payment, often these loans will go into default. The result is deterioration in the loan payment performance of these portfolios, directly tied to the risk that there are mechanical problems. This further results in increased service, collections and repossession costs and a negative impact to overall profitability for the BHPH business owner.

New car prices are likely to remain high, driven by technology costs, regulatory requirements, and production shifts resulting in higher used car costs as well. The Corporate Average Fuel Economy (CAFÉ) standards and new technologies being incorporated into vehicles will contribute to higher prices as well. Therefore, affordability will continue to be a challenge for BHPH dealers, and an opportunity for LHPH dealers, for the foreseeable future.

FEDERAL INCOME TAX DEFERMENT

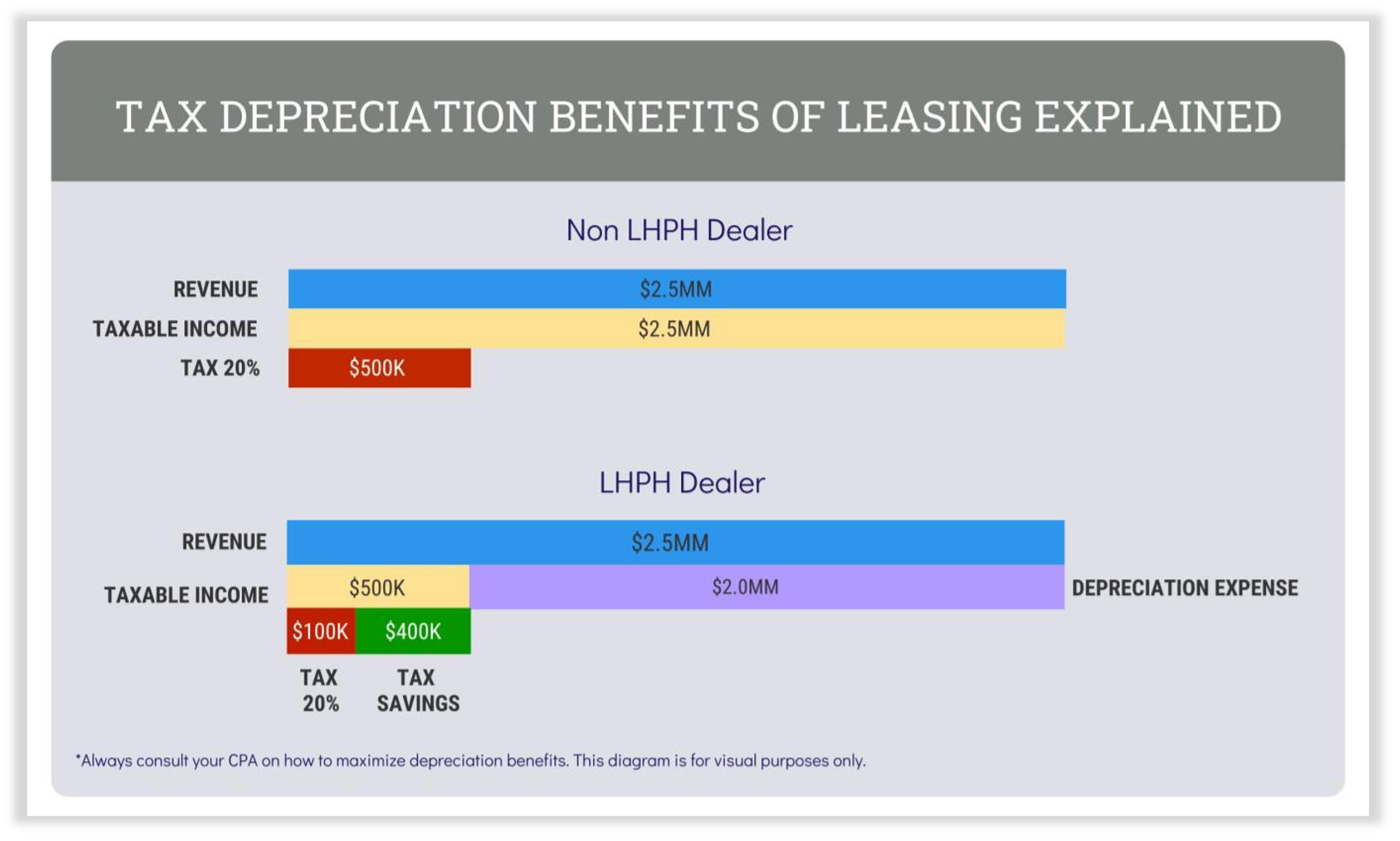

In the used car leasing model, the LHPH dealer becomes the lessor with ownership of the assets they lease to the consumer and retain in their portfolio. This opens new opportunities for the dealership from a tax perspective. The ability to depreciate the assets in your LHPH portfolio over time and report those losses on your Federal Income Tax in the form of a Net Operating Loss (NOL) is another significant advantage of LHPH. These NOL’s can allow a LHPH dealer to reduce their annual income tax liability significantly. While this has always been a compelling reason to migrate to LHPH, the new tax law in 2018 served to compound the benefits of leasing. Whether you decide to use the bonus depreciation or follow straight-line depreciation standards, either model provides strong advantages over a BHPH portfolio.

The 2018 Tax Cut and Jobs Act originally provided LHPH dealers with the ability to utilize 100% bonus depreciation of used vehicle assets in the first year for leases originated through 2023, after which the allowed percentage began phasing down by 20% each year. By 2025, bonus depreciation is scheduled to be at 60%. The proposed “Big Beautiful Bill” includes provisions that would restore 100% bonus depreciation, creating renewed and significant tax advantages for LHPH lessors if enacted. This would provide dealers with the ability to immediately expense the full cost of eligible used-vehicle assets again, improving cash flow and reducing taxable income in the year of origination. Alternatively, lessors can follow straight-line depreciation and depreciate the entire value of the asset over the life of the leased vehicle and enjoy the tax benefits over time.

An example of bonus depreciation. Imagine you lease 15 cars a month for one year with an average

Actual Cash Value (ACV) of $10,000, with bonus depreciation you could depreciate 100% of the 180 vehicles in your portfolio resulting in a total deduction of $1,800,000 against whatever profits you made from your dealership that year.

Alternatively, with the standard straight-line depreciation method, let’s imagine a dealer with 300

accounts in their portfolio and an average ACV of $10,000 per vehicle. If the dealer used a five-year

depreciation rate down to zero (20% per year), the dealer has $3MM in assets in their portfolio and

the depreciation available to claim will be $600,000 per year to offset net income.

Either way, there are strong tax advantages to a LHPH program for many years to come. It is

important to work with your CPA to forecast the impact of bonus and standard depreciation on your

current and future tax liability as you assess the right LHPH structure for your business.

SALES TAX ADVANTAGE

With traditional Buy Here Pay Here lending on retail installment sales contracts (RISC), state sales tax is paid at the time of the transaction on the sales price of the vehicle. Typically, this means the dealer uses the entire down payment for sales tax and is immediately cash-negative at the inception of the deal.

For LHPH deals in “pay-as-you-go” states*, the sales tax is calculated only on the actual monies collected by the dealer (i.e. down payment, first payment). Sales tax is then remitted to the state on each lessee payment received for the remainder of the lease. With this structure, the dealer can pay sales tax over time, rather than all up front. This helps dealers start loans on a cash positive basis, requiring less capital to growth the business as well as better unit economics throughout the life of the lease.

For example, if a BHPH dealer sells a car for $15,000 and get a $1,000 down payment on from the customer, in a state with 7% sales tax the dealer would have to pay $1,050 in sales tax to the state before even receiving the first payment from the customer. The entire $1,000 of the customer’s down payment, plus $50 of your own money just went out for tax, and it will take months of successful customer payments before your cash flow recovers from the beginning deficit in cash flow.

If you had leased this vehicle in the same state with “pay-as-you-go” sales tax, you would have paid 7% of the customer’s down payment, or $70 ($1,000 x 7%), in sales tax to the state when you put the vehicle over the curb. The other $930 of that down payment is yours. You are already in a positive cash flow position from the outset. Now the customer will make a $400 per month payment to you, of which you will remit $28 ($400 x 7%) to the state in sales tax each month. Now multiply this impact over the 10, 20, 50 deals you sell per month and leasing quickly makes an incredibly positive impact to your cash flow.

COLLATERAL CONTROL

With a traditional RISC, the dealer or their related finance company is the lien holder on the installment loan. While the lender does have some rights for repossession in the event of a customer default, there are limitations on the process in many states. Right-to-Cure notifications, requirements for Notices of Intent to Sell, and waiting periods that must be offered to the consumer for reinstatement before liquidation of repossessed inventory, among other restrictions. This means additional expenses and delays in the repossession process under a traditional loan.

With a lease, the dealer is the owner of the vehicle (the asset) and named on the title and therefore has many more rights when it comes to the recovery of their property. This can improve recovery times and reduce the post-repossession processes necessary to either lease the vehicle again or wholesale it. As always, you should consult with your local counsel to ensure you are compliant with all state and local laws surrounding consumer repossessions.

BANKRUPTCY REMOTE

Related to collateral control, but worth noting separately when considering the benefits of leasing versus traditional BHPH financing, a lease cannot be included in a bankruptcy. In the event of a bankruptcy filing, the lessee can either assume or reject the lease. If the consumer rejects the lease, they simply return the vehicle to the lessor. If they assume the lease, the lessee continues to make the agreed upon payments for the remaining term. The exposure to the lessor is greatly reduced as there is no redemption for a Chapter 7 or cramdown for a Chapter 13 possible on a lease. This difference results in fewer losses due to bankruptcy in a lease portfolio as compared with a loan portfolio.

CUSTOMER RETENTION

With a traditional BHPH transaction, the dealer makes the sale of the vehicle and will then service the loan through the term. There will be communication throughout the course of the loan, perhaps the customer makes payments at the dealership, or some contact made when a payment is missed. At the end of the contract, or when the customer decides to trade the vehicle, the customer is free to go to any dealership to trade out or they may pay off the vehicle and the vehicle is theirs. If they enjoyed the experience, the dealer may get a repeat customer, but there is no guaranty.

With a LHPH transaction, the dealer maintains significantly stronger customer control. The initial transaction and the collections process are similar. However, considering the value of the asset to the dealer and the desire to turn that asset multiple times, many dealers will roll a warranty into the lease to bring the customer back in for regular maintenance. This maintains the dealer’s asset as well as fosters “customer touch.”

Next, depending on the dealer’s program and lease contract, the customer is made aware they have an option to return the vehicle for a nominal early termination fee. If a quality customer decides they would like to trade up for another vehicle, they can. Many LHPH dealers offer trade up incentives for payment performance allowing a customer to get into a new vehicle before their lease contract comes to term.

For those customers who pay the lease to maturity, the opportunity for retention is far superior to BHPH. The lessee must bring your vehicle back to your dealership when the lease ends. At that time, your sales team can work with them to decide if they would like to purchase the vehicle for the residual value or lease a new vehicle entirely. The opportunity to retain your quality customers with a LHPH product is an incredible advantage over traditional financing.

RESIDUAL CASHFLOW

Not unlike Buy Here Pay Here, the average term on Lease Here Pay Here portfolios tend to hover around 36 months. Therefore, once your dealership has been originating leases for three to four years, your portfolio will begin to mature.

Unlike BHPH, when a LHPH customer completes the term of their lease, they are going to be returning to your dealership to do one of three things:

- The customer may return the vehicle and walk away leaving you with the asset.

- They may choose to return the vehicle and lease another vehicle from you.

- The customer may elect to buy the vehicle from you for the residual value.

Regardless of which decision the customer makes, the dealership will experience an astonishing influx of cash either by wholesaling the vehicle, selling the unit to the customer for the residual, or leasing the paid off vehicle again. Residual cashflow is the most dynamic aspect of leasing and offers incredible opportunities for dealers that remain disciplined in building their portfolios to the maturity inflection point.

FLEXIBILITY TO ADAPT TO CHANGING MARKET CONDITIONS

The landscape in the auto industry is currently experiencing an exciting injection of new, disruptive products and ideas. The future of vehicle technology, consumer affordability relative to vehicle cost, the introduction of ride-share, subscriptions, experimentation with new ownership models, and the ever changing wants and needs of the younger generations has created a degree of uncertainty and opportunity in the industry. The Lease Here Pay Here model provides dealers with the flexibility to adapt to this changing market.

Leasing allows the dealer to overcome the affordability challenges for consumers when compared to the traditional installment loan. A dealer can build their own version of a used-car subscription program by rolling maintenance and insurance into the lessee’s payment. Creative lease programs geared to ride-share drivers are beginning to appear across the country. Even the structure of your leasing program itself can be adjusted over time to adapt to the evolving needs of your local market. LHPH offers dealers a range of opportunities that BHPH simply cannot compete with.

HOW LHPH CAPITAL WORKS

Lease Here Pay Here

Get access to our FREE! e-book and learn how to launch a Lease Here Pay Here program at your dealership. It might just be the best decision you made all year!

Get my FREE! e-bookHow to Launch Your LHPH Program

- Determine "Pay-As-You-Go" Status

- Review and Understand M

- Identify a LHPH Compatible DMS

- Licensing and Forms

- Engage Legal Counsel with Consumer Leasing Experience

- Insurance Requirements and the Graves Amendment

- Retain an Accounting Firm with Consumer Leasing Expertise

- Enlist an Expert Advisor

- Develop Internal Credit and Collections Procedures

- Identify a Lending Partner

- Training Your Staff

The roadmap to launching your own LHPH platform requires step-by-step action plan whether you are a current BHPH dealer looking to make the transition or a dealer seeking opportunities to provide lending and transportation solutions to your community while improving your bottom line.

LHPH is the ideal product to bring affordability, profitability, and a competitive advantage to your dealership.